city of richmond property tax rate

Paying Your Property Taxes. Interactively search the Citys property database here using criteria eg.

Manage Your Tax Account.

. Best 5-Year Variable Mortgage Rates in Canada Butler Mortgage. To contact City of Richmond Customer Service please call 804-646. The Mayor and Council of the City of Richmond Hill do hereby announce that.

City of Richmond Hill Property Tax. Any returns filed after May 1 st are assessed a late filing fee of ten dollars 10 or ten percent 10 of the tax assessed whichever is greater. 105 of home value Yearly median tax in Richmond City The median property tax in Richmond City Virginia.

239 West Main St. City of Richmond 2019 and newer property taxes real estate and personal property are billed and collected by the Ray County Collector. Richmond property tax rates are the fourth lowest property tax rates in BC for municipalities with a population greater than 10K.

Property Taxes are due once a year in Richmond on the first business day of July. Richmond KY 40475 859 623-1000 Justice Education Industry Finance. Mon day July 4 2022.

Councilwoman Kristen Nye meanwhile proposed cutting the rate by 4 cents to 116 per 100 value noting that the current budget was based on a spring forecast that this. Richmond City Assessors Office 900 E. Richmond City Virginia Property Tax Go To Different County 212600 Avg.

The current property tax rate in Richmond Virginia is 120. The City Assessor determines the FMV of over 70000 real property parcels each year. With the 13 jump the property owner would pay 624.

The current millage rate is 4132. The assessed value is then used to. 2022 Tax Digest and Levy 5-Year History.

Understanding Your Tax Bill. 2 days agoA city resident with property assessed at 400000 would have an annual tax bill of 4800 under the citys current tax rate. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate.

Due Dates and Penalties for Property Tax. Building Department. The City Assessor determines the FMV of over 70000 real property parcels each year.

Broad St Rm 802 Richmond VA 23219 Phone. RICHMOND CITY HALL 450 Civic Center Plaza Richmond CA 94804. For information and inquiries regarding amounts levied by other taxing authorities.

Below you will find links and resources to pay admissions lodging meals real estate and personal property taxes as well as parking violations online. 804 646-7500 Fax. Building Department.

Admissions Lodging and Meals. Richmond residents will have until July 4 to pay their property taxes without. This rate is applied to the assessed value of your property as determined by the city assessor.

804 646-5686 1999-2022 City of Richmond Virginia. Effectively the city is providing relief in addition to what. To provide additional relief to those who automatically qualify the city has elected to freeze the PPTRA rate at the same rate as 2021.

Para solicitar una traducción llame al centro de servicio al cliente de la Ciudad de Richmond al 804-646-7000 o 3-1-1. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate. To pay your 2019 or newer property taxes online.

Assessment Methodology Individual. These agencies provide their required tax rates and the City collects the taxes on their behalf. Parcel ID Address Land Value and Consideration Amount.

Toronto Property Taxes Explained Canadian Real Estate Wealth

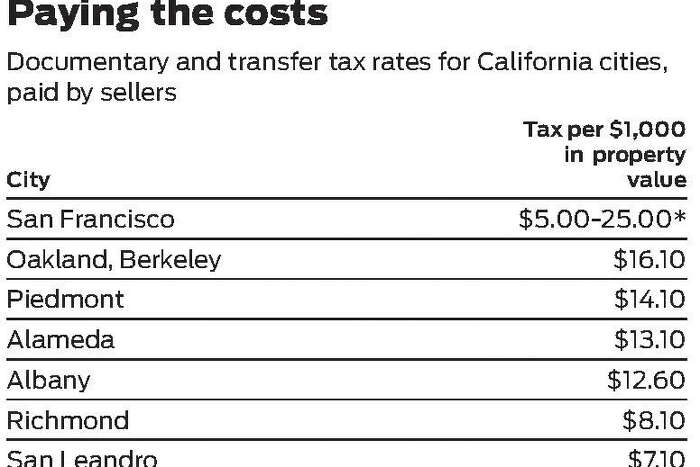

Sf Proposes Transfer Tax Increase On Properties Over 5 Million

Fees Richmond Ca Official Website

Can You Explain The Proposed Property Tax Increase For Knoxville Tennessee Mansion Global

Ontario Property Tax Rates Lowest And Highest Cities

Maine Property Tax Rates By Town The Master List

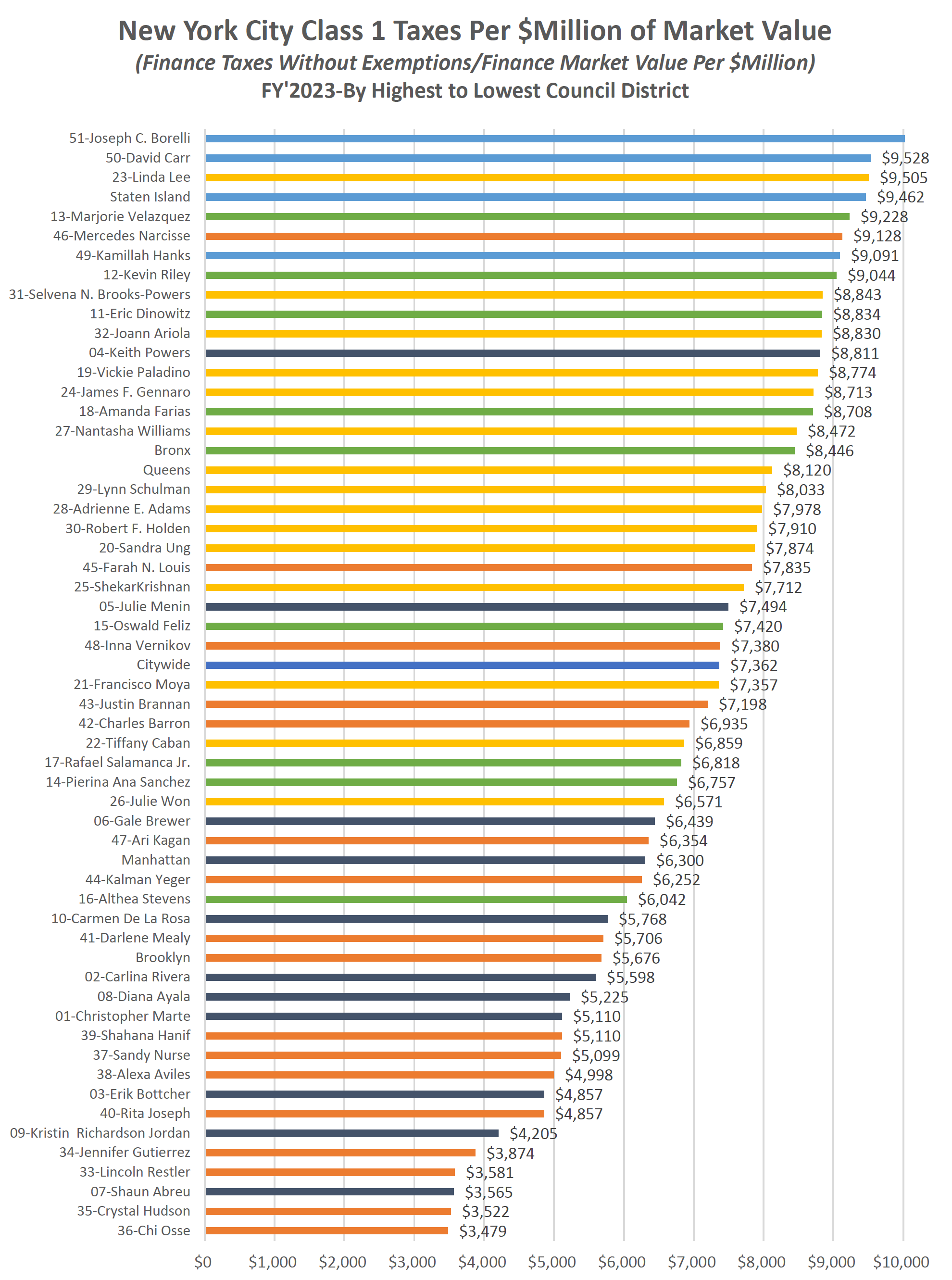

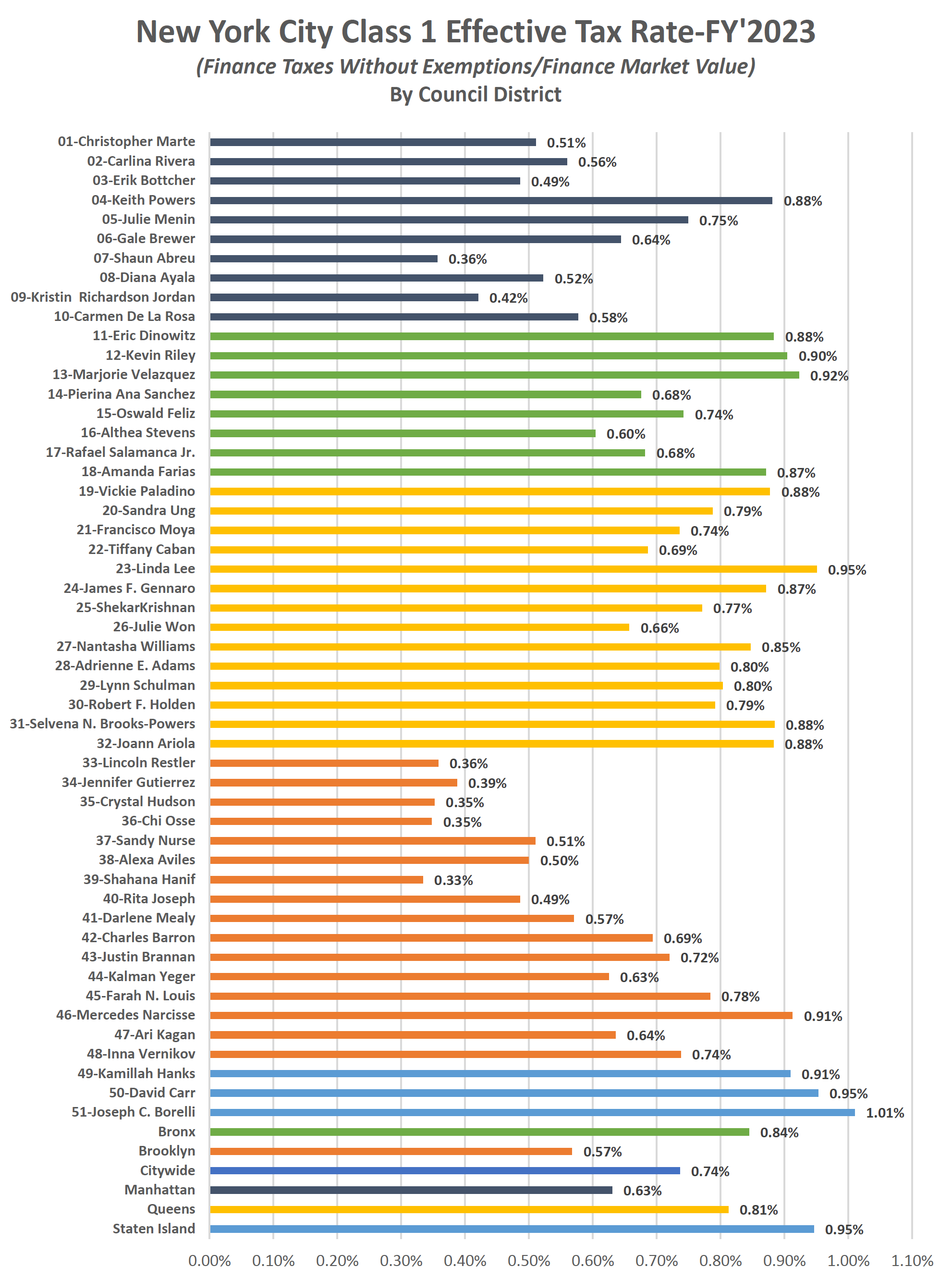

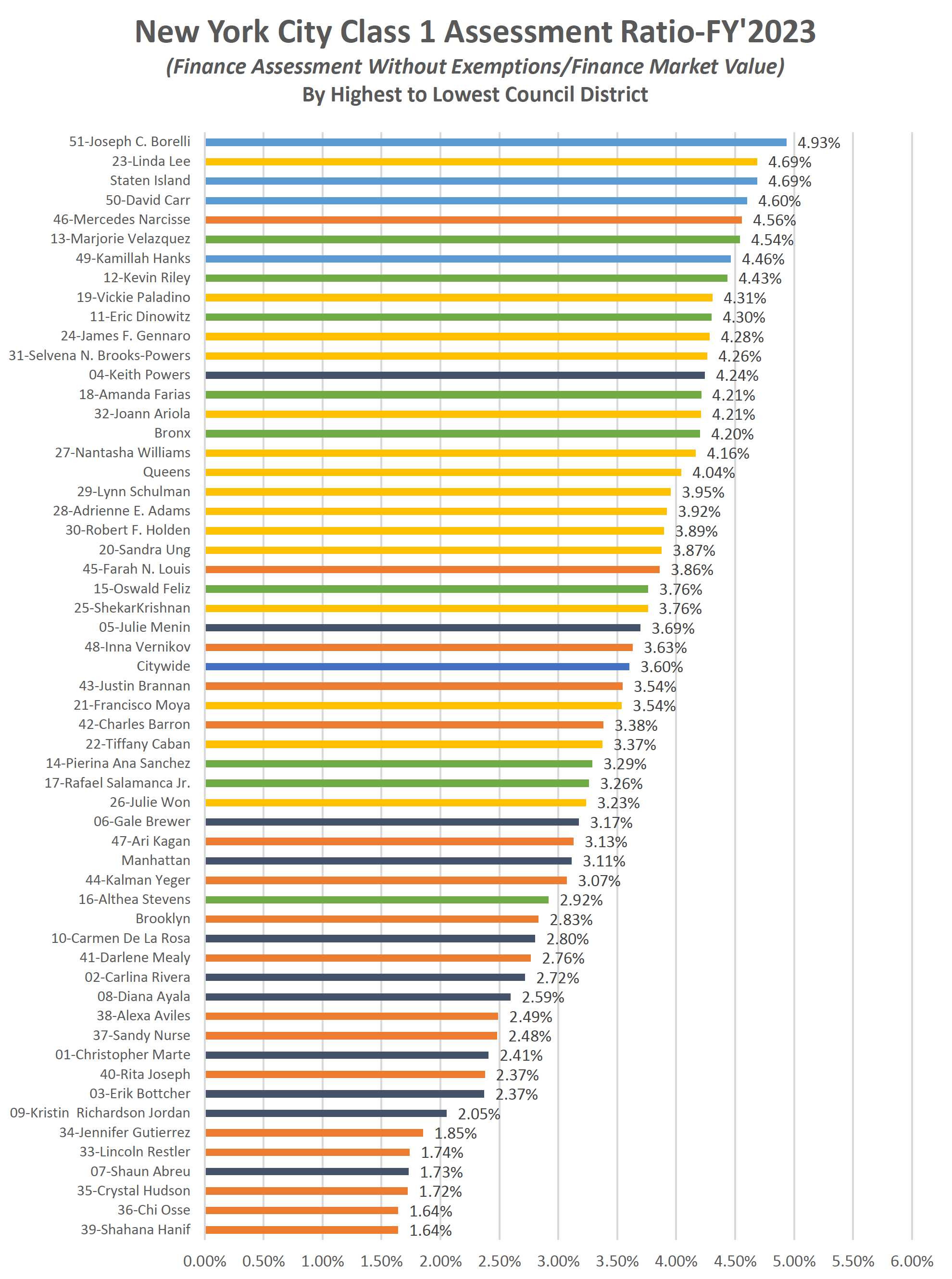

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

Virginia Property Tax Calculator Smartasset

Property Taxes In Texas This Is How To Check How Much You Re Paying Where Your Money Is Going Your Proposed Rate

Calls Mount For City S Property Tax Decision Richmond Free Press Serving The African American Community In Richmond Va

Soaring Property Taxes Renew Calls For Cuts Richmond Free Press Serving The African American Community In Richmond Va

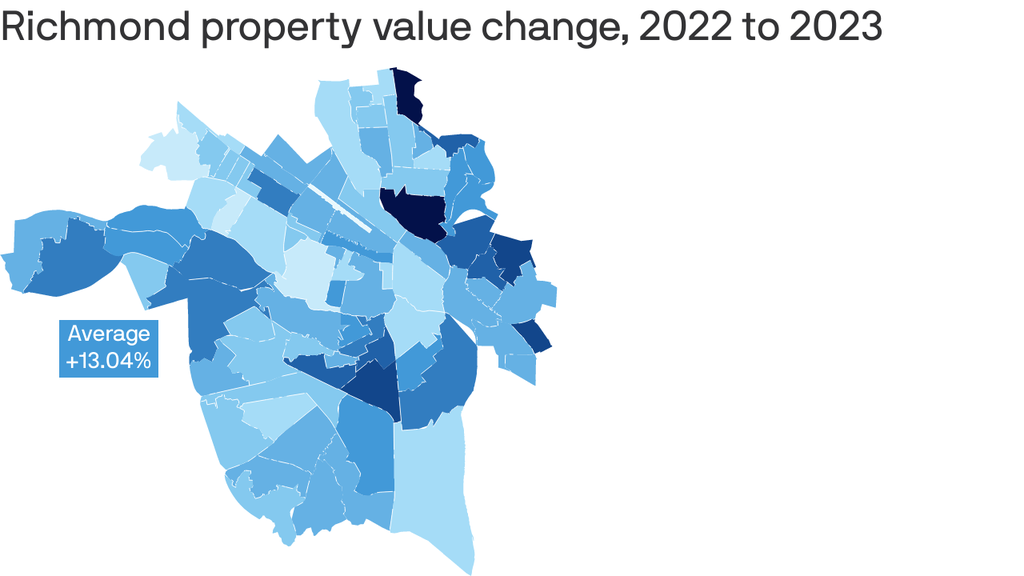

Where Richmond Property Values Went Up Most Axios Richmond

New York City Property Tax Rate Is It Worth Selling

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

Ontario Cities With The Highest Lowest Property Tax Rates October 2022 Nesto Ca

Proposals To Cut Richmond S Real Estate Tax Rate Move Forward Without Recommendations Wric Abc 8news

Lubbock City Council Adopts Amended Budget No New Revenue Tax Rate

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now